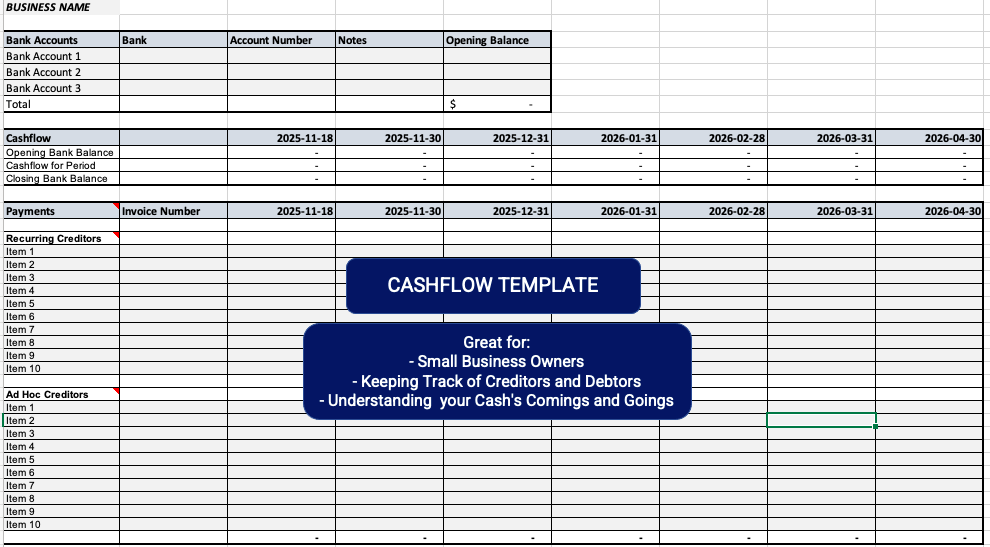

Cashflow Template

KCS’s cashflow template

Simple, convenient, empowering.

Instructions can be found below and in the template’s “Instructions” tab.

Instructions for Completing the Cashflow Template

Please note that only cells coloured grey are editable.

Any cells that are not coloured are associated to formulas or components that should not be edited.

Step 1: Setup Business Name

Enter business name in cell A1

Step 2: Setup Bank Details and Amounts

Enter any bank account details and any notes into cells B4 through D6.

Enter only bank accounts that are used in the course of the business.

This can include chequing, savings, and credit cards.

Enter current amounts in column E of the associated account

Step 3: Enter Creditors

Creditors are people that you owe money to.

There are two options, recurring creditors and ad hoc creditors.

Recurring creditors are bills that are received monthly for very similar amounts.

These can include rent payments, subscriptions, electricity, phone, internet, etc.

Enter the name of the creditor in column A, the invoice number (if known) in column B, and associated bill amounts in columns C through I depending on their due dates.

The monthly amount can then be entered into columns F through I.

Ad Hoc creditors are bills that come in as one-offs.

You can also use the ad hoc payments for payments that you know are coming up in future months.

For example, there is a yearly insurance bill for $3,500, due in 4 months time, which can be entered into the appropriate column.

Step 4: Enter Debtors

Debtors are people that owe you money to.

There are two options, recurring debtors and ad hoc debtors.

Recurring debtors are receipts that are received monthly for very similar amounts.

These can include rent payments, grants, sales, etc.

Enter the name of the debtor in column A, the invoice number (if known) in column B, and associated receipt amounts in columns C through I depending on their estimated receipt dates.

The monthly amount can then be entered into columns F through I.

Ad hoc debtors are receipts that come in as one-offs.

As an example, you applied for a government grant that comes in once a year.

Depending on its terms, the receipt can be entered in whichever column matches.

You can also use the ad hoc receipts for receipts that you know are coming up in future months.

Step 5: Review Cashflow

Based on all the information entered, the cashflow for your business will be reflected in rows 10 to 12.

Row 10 will show your expected opening bank balance every month.

Row 11 will show the cashflow for the period.

Row 12 will show your expected closing bank balance every month.

Rows 11 and 12 have conditional formatting set so if the cells show amounts less than $0.00, they will colour red.

Ideally, there should be no red in row 12.

Red in row 11 suggest a negative cashflow month.

Step 6: Contact KCS for Assistance or with any Questions

We're here to help.

If any of this does not make sense to you, please contact us and we will be happy to assist.